Introduction

Each month, Chaos Labs delivers comprehensive, data-driven analysis of Renzo’s key metrics, ensuring full transparency for the community. By closely monitoring utilization trends, liquidity dynamics, and borrower behaviors, Chaos Labs aims to proactively identify and mitigate emerging risks to maintain protocol stability.

Performance

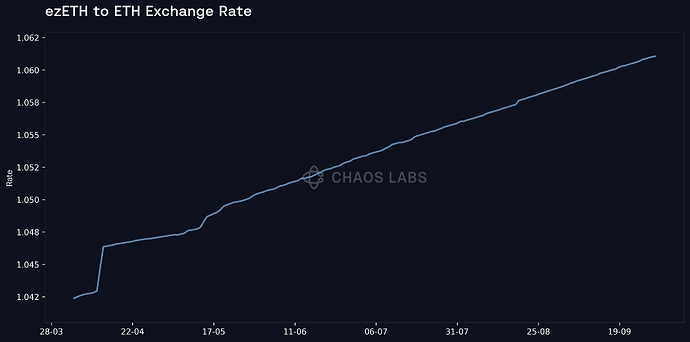

In September, ezETH recorded steady yield growth, with the exchange rate increasing from 1.0587 at the start of the month to 1.0611 by month-end. This reflects a realized APR of approximately 2.7%, underscoring consistent accrual of rewards.

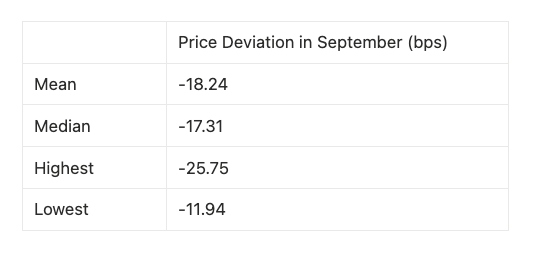

Thourough the month, ezETH traded at a modest discount to ETH, with deviations ranging between a maximum of -0.26% and a minimum of -0.09%. Compared to August, when discounts deepened as far as -0.38%, September exhibited a narrower and more stable range, suggesting gradual recovery from the liquidity stress observed in July. While the peg has not yet returned to pre-July levels, the more contained volatility this month highlights improved market stability and absorption capacity.

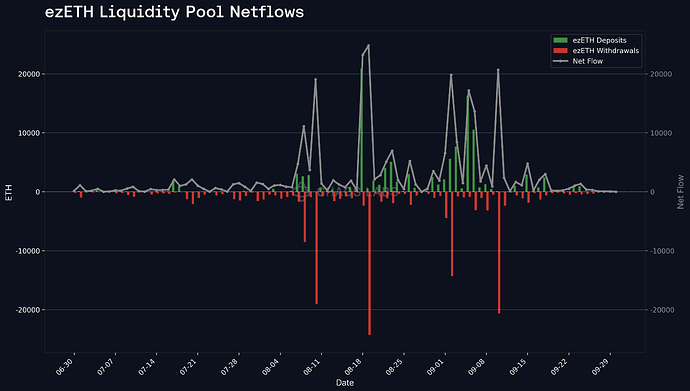

Renzo’s TVL remained resilient, with flows marked by several large inflow and outflow events. The month featured notable deposit spikes on September 5 and 6, totaling over 25,000 ETH, as well as sharp outflows on September 10 and 14, each exceeding 10,000 ETH. Despite these episodes of volatility, cumulative netflows stabilized toward month-end.

Liquidity

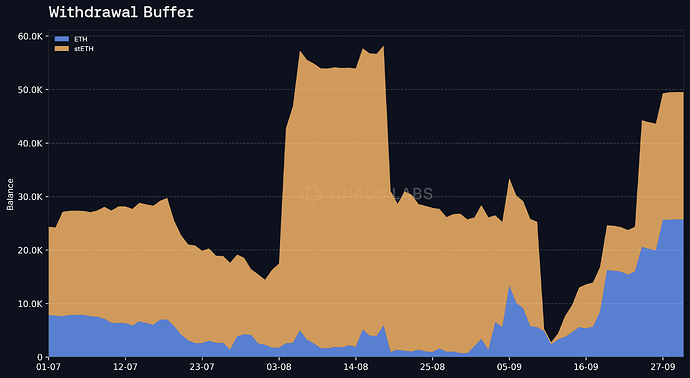

In September, the withdrawal buffer composition shifted, with both ETH and stETH balances contributing meaningfully. By month-end, the buffer held approximately 25.7K ETH and 23.8K stETH, reflecting a stronger ETH allocation compared to August. This adjustment enhanced the protocol’s ability to service redemptions directly in ETH, while maintaining a sizable stETH reserve as an additional backstop. Overall, the buffer closed the month at healthy levels, providing robust coverage against withdrawal demand.

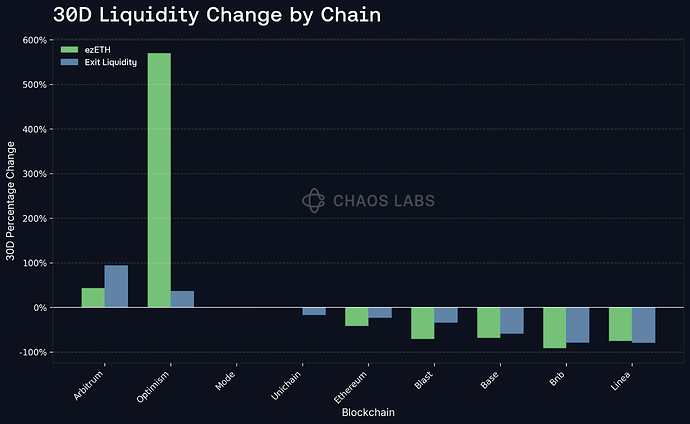

This month’s cross-chain liquidity flows were led by a sharp expansion on Optimism, where ezETH balances grew materially alongside a rise in exit liquidity. Arbitrum also recorded moderate growth, while Ethereum experienced a slight reduction in liquidity. Compared to August, when BNB was the primary driver of growth, September marked a clear rotation toward Optimism as the main hub of ezETH activity.

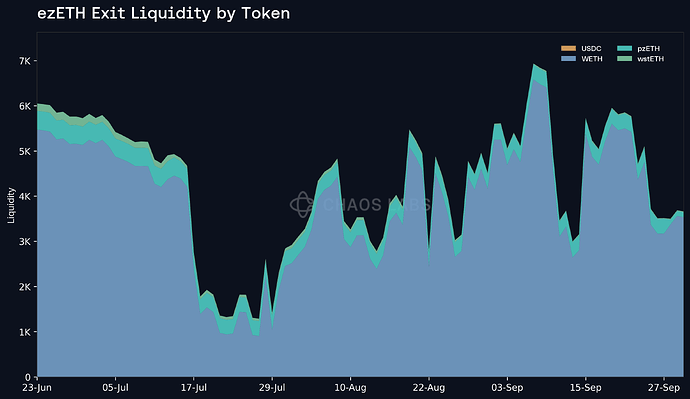

Exit liquidity improved in September, with WETH continuing to serve as the dominant redemption asset, supplemented by smaller but steady balances of wstETH and USDC. Compared to August, where exit depth had already begun to recover from July’s lows, September saw further stabilization, with liquidity levels consistently maintained above early-summer troughs.

Composability

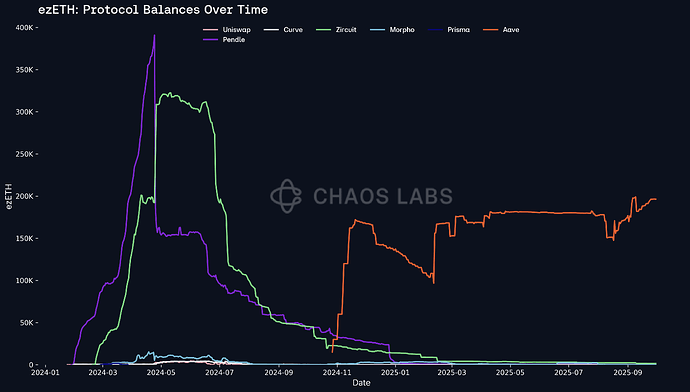

Aave continued to serve as the primary venue for ezETH demand, recording further growth in balances across Ethereum and Linea.

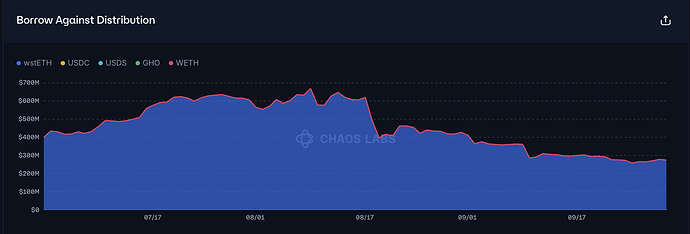

On Ethereum Prime, outstanding borrows trended lower from early August highs, stabilizing around $300M by month-end. Ethereum Core also saw a slight decline in utilization, with balances moving closer to $200M. In contrast, Linea expanded as a new source of ezETH-backed borrowing, with volumes rising steadily through the month and closing just above $250M. Together, these shifts highlight a rebalancing of borrowing demand, with activity consolidating on Ethereum while Linea emerged as a growing market.

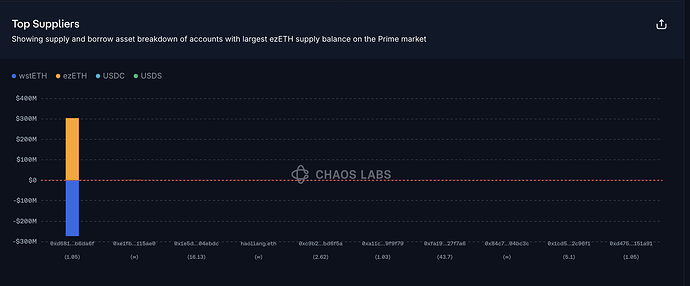

Ethereum-Prime

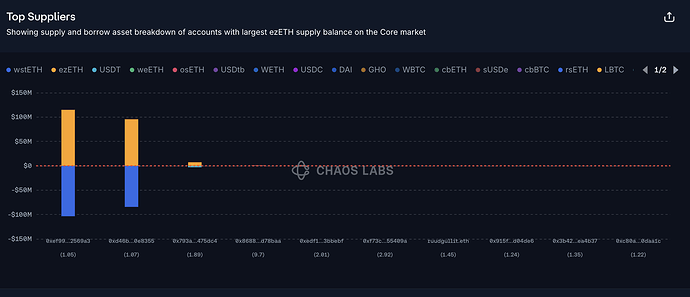

Ethereum-Core

Linea

Supplier concentration remained elevated in September, with a small number of large accounts dominating ezETH deposits across Aave markets. On Ethereum Prime, the leading supplier continued to hold several hundred million dollars in ezETH, while Ethereum Core and Linea each showed similar patterns of outsized positions among a handful of wallets. This concentration underscores a structural risk, as liquidity conditions could be impacted disproportionately if one or more of these major suppliers were to unwind their positions.

Ethereum-Core

Ethereum-Prime

Linea

Summary

In September, ezETH maintained steady yield growth, delivering a realized APR of around 2.7%. Peg deviations narrowed compared to August, with discounts contained between -0.09% and -0.26%, reflecting improved stability following the volatility earlier in the summer. Liquidity conditions strengthened, as the withdrawal buffer expanded materially in ETH and exit liquidity remained well diversified across tokens. Overall, the protocol demonstrated resilience and stability, with no acute risks observed during the month.