Introduction

Each month, Chaos Labs delivers comprehensive, data-driven analysis of Renzo’s key metrics, ensuring full transparency for the community. By closely monitoring utilization trends, liquidity dynamics, and borrower behaviors, Chaos Labs aims to proactively identify and mitigate emerging risks to maintain protocol stability.

Performance

In October, ezETH steadily appreciated against ETH, with the ezETH/ETH exchange rate rising from 1.06112 ETH to 1.06376 ETH. This reflects an effective realized APR of approx. 2.8%, consistent with prior months and indicative of stable yield accumulation.

During the mid-October market flash crash, ezETH’s discount briefly widened to around -0.20%. The peg then recovered steadily, tightening to up to -0.04% by month-end, reflecting effective arbitrage activity restoring ezETH’s peg with ETH.

During the mid-October market flash crash, ezETH experienced a brief spike in outflows, quickly followed by renewed inflows. Throughout the month, TVL remained stable at approximately 320k ETH for ezETH.

Liquidity

Throughout the month, Renzo’s withdrawal buffer remained well-capitalized, ending the month with around 28k ETH and 8k stETH. stETH was the primary asset utilized for withdrawals, while the ETH portion of the buffer stayed relatively stable. Despite some mid-month fluctuations, the buffer quickly rebalanced, maintaining ample liquidity.

Ethereum, Base, and Unichain all saw substantial declines in both ezETH and exit liquidity over the past 30 days. In contrast, Linea recorded strong inflows, with ezETH liquidity rising sharply, while Arbitrum saw a notable increase in exit liquidity.

DEX exit liquidity remained concentrated in WETH, which consistently dominated balances between ~3,500 and 4,800 ETH. wstETH saw modest fluctuations. Overall, DEX exit liquidity composition stayed largely unchanged month-over-month.

Composabilty

Aave continued to hold the largest share of ezETH deployed across DeFi protocols, maintaining balances around 190k–197k ezETH. Compound saw meaningful growth, increasing from roughly 10k to over 21k ezETH, reflecting rising demand for ezETH as collateral. Smaller integrations such as Morpho Blue, Fluid, and Zircuit maintained stable balances.

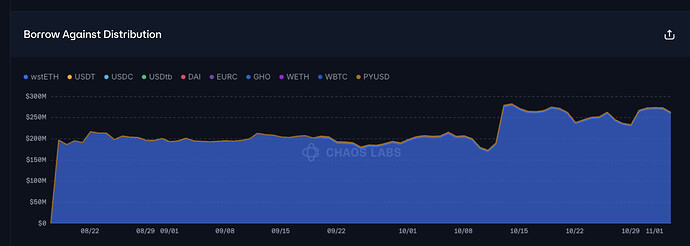

Borrow activity against ezETH on Aave’s Ethereum core market grew steadily over October, with total borrows rising from about $198 million to over $272 million by early November. The supply side also expanded, increasing from roughly $197 million to around $309 million during the same period. wstETH continued to dominate as the main borrowed asset, accounting for more than 98% of outstanding positions. Borrowing activity on Aave’s Prime market declined sharply in October, with total borrows falling from around $285 million to about $106 million by month-end. This was accompanied by a reduction in ezETH supply, which decreased from approximately $319 million to $120 million over the same period. On Linea, ezETH’s second-largest chain exposure, both supply and borrowing volumes saw a minor contraction. When combining all Aave markets, the net effect is a moderate overall decline in borrowing activity and total ezETH supplied in October.

Ethereum-Core

Supplier concentration on Aave’s Ethereum Core market increased in October, with the largest wallet expanding its share of total ezETH deposits relative to the previous month. This top supplier now holds a significantly larger portion of total supply. The market therefore remains highly concentrated, with liquidity primarily dependent on one or two major participants. On Aave’s Ethereum Prime market supplier concentration decreased, as the largest supplier reduced its position compared to the previous month. Supplier concentration on Linea remained effectively unchanged. The same top wallets continued to dominate ezETH supply, maintaining a similar proportional distribution to the previous month. However, total supplied positions decreased slightly across the board, indicating lower aggregate participation rather than a shift in concentration.

Ethereum-Core

Ethereum-Prime

Linea

Summary

In October, ezETH maintained stability and steady growth despite broader market volatility. The ezETH/ETH rate increased, yielding a realized APR of about 2.8%, while the peg recovered quickly following the brief market-wide flash crash mid-month. Liquidity remained healthy, with the withdrawal buffer well-capitalized at roughly 28k ETH and 8k stETH. Overall, despite the flash crash, Renzo demonstrated strong resilience with stable peg performance, balanced liquidity.