Introduction

Each month, Chaos Labs delivers comprehensive, data-driven analysis of Renzo’s key metrics, ensuring full transparency for the community. By closely monitoring utilization trends, liquidity dynamics, and borrower behaviors, Chaos Labs aims to proactively identify and mitigate emerging risks to maintain protocol stability.

Performance

August marked another month of stable performance for ezETH, providing holders with consistent and reliable yield. The ezETH/ETH exchange rate increased from 1.0560 to 1.0586 on throughout the month, representing a realized APR of approx. 3.0%. This steady appreciation highlights the protocol’s resilience and ability to sustain yield generation.

In August, peg deviations remained contained following the liquidity crunch in July, with ezETH consistently trading at a modest discount to ETH. The smallest deviation occurred on August 7 at around -0.09%, while the largest was observed on August 15 at approximately -0.38%. For most of the month, deviations fluctuated within a narrow range of -0.20% to -0.30%, reflecting limited volatility around the peg. While the situation has improved, ezETH has yet to fully recover to pre-July levels.

August netflows were volatile, characterized by several large swings in deposits and withdrawals. Mid-month saw two significant withdrawal events, each around 20,000 ETH, creating sharp temporary outflows. These were offset by a major deposit spike of similar scale, followed by steady inflows in the latter half of the month. Overall, the system demonstrated resilience as deposits consistently rebalanced withdrawals.

The withdrawal buffer saw a notable increase in early August, peaking above 55,000 stETH, which served as the primary backstop for liquidity and helped absorb withdrawal activity during periods of elevated outflows. Toward the end of the month, balances normalized but continued to provide a comfortable cushion relative to withdrawal demand. While ETH liquidity could be strengthened, the buffer overall maintained a healthy available size.

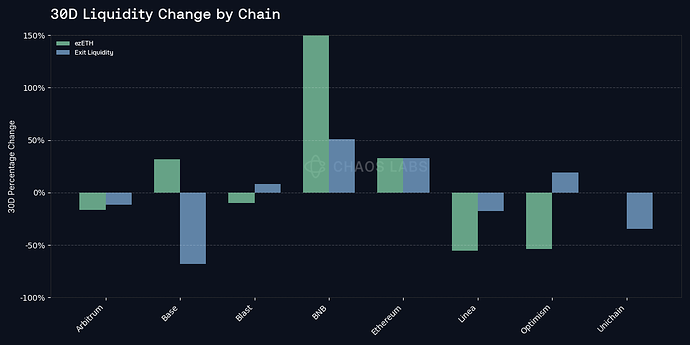

Liquidity distribution across chains shifted notably in August. BNB posted the strongest growth, with ezETH liquidity expanding by over 150% alongside a sizable increase in exit liquidity. Ethereum also recorded solid growth of around 30% in both ezETH and exit liquidity, reinforcing its position as the core liquidity hub. In contrast, Unichain saw a decline in exit liquidity without corresponding ezETH growth, while on Base, ezETH liquidity rose moderately but also saw a sharp contraction in exit liquidity, signaling reduced redemption depth on that chain.

Exit liquidity by token declined throughout August, extending the downtrend that began after July’s liquidity crunch. wETH remained the primary source of redemption capacity, while complementary assets such as wsETH, pzETH, and USDC contributed at smaller and diminishing levels. Although early August saw a brief rebound, DEX exit liquidity weakened into month-end.

Composability

On Ethereum, protocol integrations declined over August, driven primarily by a reduction in Aave TVL on mainnet. Other integrations such as Curve, Balancer, and Pendle remained relatively minor in comparison and showed limited change.

The decline in Aave TVL on Ethereum during August can be largely attributed to a migration of funds to Aave’s Linea instance, reflecting a broader trend across tokens. For ezETH specifically, this shift was supported by an increase in supply caps and an adjustment to LTV, with total ezETH supply on Linea now exceeding $120M.

On Ethereum, wstETH remained the dominant borrow asset, while on Linea, demand concentrated around wETH, both reflecting similar looping strategies.

August saw the launch of ezETH on Aave’s Core market, with total supply already reaching around $250M. At the same time, supplier distribution on the Prime market shifted as the second-largest supplier migrated their position to the Core market. This left the leading supplier with a significantly larger share relative to others, increasing concentration on the Prime side. By contrast, supplier distributions on the Core and Linea instances appear more balanced.

Summary

In August, ezETH maintained stable performance, delivering consistent yields with a realized APR of ~3.0%. Peg deviations remained contained, though ezETH continued to trade at a discount to ETH, not yet fully recovering to pre-July levels.

Liquidity conditions were marked by volatility in netflows, a strong withdrawal buffer, and meaningful shifts across chains, with BNB and Ethereum emerging as key liquidity hubs while Base and Unichain saw weaker redemption depth.

Composability shifted with funds migrating from Aave mainnet to Linea, where ezETH supply surpassed $120M following cap increases and LTV adjustments. The launch of ezETH on Aave’s Core market added further growth, though supplier concentration rose on Prime. Overall, the protocol remains stable, with resilience in yield and liquidity despite localized risks.